How Does One Begin the Path Then Continue on the Path of Financial Wisdom

Starting something new is always the hardest part of the process.

Starting the path to financial independence is no different.

While financial independence is a goal for a lot of people, many don't start their path towards that goal because they don't know where to begin.

Today, I'll be discussing the three strategies that I implemented when I started my path to financial independence that led to be being 14.9% financially independent by 27 years old.

Let's dive in.

Strategy 1 – Creating a Target

The first question one should ask is "What type of financial independence do I want to pursue?"

According to a recent study by Northwestern Mutual, 56% of American adults don't know how much they will need to retire comfortably.

As a result, it's easy to say: "I need $10,000,000 to retire." However, is that a realistic number based off your current and projected future lifestyles?

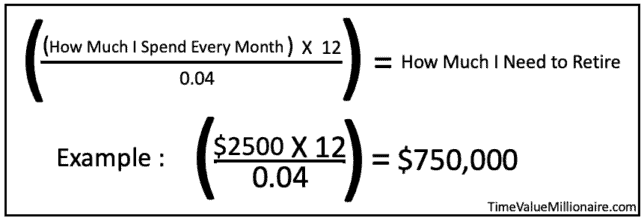

A quick and easy way to find out is by recording your expenses over 4-6 months, calculating an average monthly budget, and performing the below calculation:

Here is how the calculation works:

- Multiplying your average monthly expenses by 12 will give you your estimated annual budget.

- Dividing your estimated annual budget by your safe withdrawal rate will result in the portfolio required to support your lifestyle.

Note: In this case, I am using 4.00% as the withdrawal rate. This is a common safe withdrawal rate to use that is based on research from the Trinity Study. You can adjust the withdrawal rate based on your own individual risk preferences.

This exercise should be repeated every few months in order to adjust for what your new average monthly expenses are. As more data is added, the "How Much I Need to Retire" amount will begin sharpen into what your actual number is.

The final result is a good baseline for your financial independence goals. By first creating a target, you can then begin researching what financial strategies align with your life goals.

Strategy 2 – Paying Yourself First

Financial independence requires a lot of savings, there's no way around it.

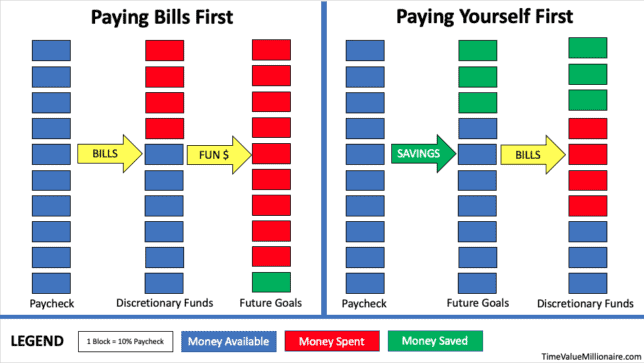

As a result, it's critical to structure your budget to prioritize your savings goals as opposed to discretionary spending.

Automating the act of paying myself first is the single most important thing that I have done to reach where I am at today. This prioritization on savings first has directly resulted in me being able to save over 40% of my income every month.

Before I do any discretionary spending, a certain percentage of my income is automatically saved before I have the chance to spend it.

Here is a visualization of how this system works:

After spending a total of twenty minutes to schedule automatic withdrawals with my credit union and Fidelity, I have effectively automated the "Paying Yourself First" system.

This automated system ultimately gives me the peace of mind knowing that I don't have to do anything extra to meet my savings goal every month… because it already happened!

Strategy 3 – Living Below Your Means

I believe the number one thing that turns people off when they first hear about financial independence is the notion that you must live a life of total deprivation at all costs.

However, that couldn't be farther from the truth.

The truth is that financial independence is a spectrum.

I personally have a larger food bill than what many in the FI community would recommend. However, I actively make that choice because cooking and baking with Mrs. TVM is something that enriches our relationship and life overall.

Christmas Cookie Day is the best day of the year!

Living below your means is not equal to deprivation of enjoyment. Instead, it is asking yourself the hard questions to understand what spending your money on will really make you happier.

I save over 40% of my monthly income not only because I want to hit financial independence one day, but because I am also content with my current spending habits. I know for me personally, spending another 40% won't make happier.

The lesson here is that as long as you maintain a positive savings rate while simultaneously building a life guided by your values, then you are doing everything right.

Final Thoughts

I remember reading about financial independence for the first time and becoming immediately consumed by the concept. I was excited for what it could possibly mean for my life.

However, I didn't know where to start. I was intimidated.

Fortunately, I just started and am now financially in a place where I never thought was possible to be at 25 years old.

Have you started your path to financial independence? If so, what were some of things you did to get started?

Thank you for reading! 🙂

_

Full Disclosure: Nothing on this site should ever be considered advice, research or an invitation to buy or sell securities, please see my 'Terms & Conditions' page for a full disclaimer.

Source: https://www.timevaluemillionaire.com/starting-path-to-financial-independence/

0 Response to "How Does One Begin the Path Then Continue on the Path of Financial Wisdom"

Post a Comment